Contract management and ESG reporting requirements: what’s the connection?

Embedding strong ESG clauses in contracts is proving to be essential for companies operating in the European Union, where sustainability reporting standards continue to evolve amid 2026 enforcement milestones.

Key frameworks include the Corporate Sustainability Reporting Directive (CSRD) (with Omnibus simplifications narrowing scope), EU Taxonomy, Carbon Border Adjustment Mechanism (CBAM) (fully effective as of January 1, 2026), and EU Deforestation Regulation (EUDR) (starting December 30, 2026). Organizations must collect, track, and assure robust ESG data, particularly Scope 1–3 emissions, across their value chains.

This article explains how contract management ties directly into EU ESG reporting requirements, the types of clauses that drive compliance, and the operational benefits and challenges of linking contract obligations to sustainability goals.

How contract management enables ESG reporting requirements

ESG reporting requires trustworthy, auditable data, often far beyond what one business can produce alone. Contracts let you push sustainability commitments and data obligations down the supply chain, creating legal leverage to get the information and performance you need from suppliers and partners.

Common contract types that require sustainable procurement include supplier agreements, procurement contracts, and joint venture arrangements. By embedding ESG contract clauses, you can:

- Mandate emissions tracking and reporting (including Scope 1-3 data)

- Require ethical sourcing and diversity data from suppliers

- Set, monitor, and enforce environmental and social targets

- Create audit rights and paths to remediation if standards are missed

These obligations bring order to the complex ESG compliance process, especially where reporting relies on third-party information. Contract lifecycle management (CLM) platforms help streamline the creation, negotiation, and monitoring of those ESG clauses at scale.

Key ESG clauses in contracts for reporting compliance

Not all ESG clauses offer the same regulatory value. Under EU directives, the most effective contract terms are those that convert supplier commitments into measurable and verifiable data. Common categories include:

- Reporting obligations: Suppliers provide periodic data covering Scope 1-3 emissions, energy use, waste, or diversity. Automatic reminders and warranties are common.

- ESG audits and monitoring: The right to audit, set KPIs tied to deliverables, and trigger consequences for non-compliance such as service credits or termination.

- Environmental and social targets: Commitments to net-zero, use of recycled materials, or fair labor practices, measured against recognized benchmarks.

- Governance and ethics requirements: Adherence to anti-bribery, privacy, and community engagement standards.

AI-driven CLM tools can track clause performance and centralize ESG metrics, supporting continuous disclosure and risk monitoring.

2026 EU ESG reporting frameworks and contract implications

Upcoming legal frameworks make ESG compliance non-negotiable. Companies face tough penalties and reputational damage for missing mandatory ESG reporting requirements. Several key EU regulations are active or ramping up in 2026, raising the compliance bar across sectors:

| Jurisdiction/Rule | Key Requirements | Contract Implications |

|---|---|---|

| CSRD (Omnibus-updated) | Applies to EU companies with over 1,000 employees and more than €450M in net turnover. Wave 1 reports (legacy NFRD/large firms) continue into 2026; Wave 2 is delayed until 2028. Covers Scope 1–3 emissions under ESRS E1. | Contracts must require suppliers to share and verify ESG data for value-chain and double materiality reporting (lighter requirements for SMEs). |

| EU Taxonomy | Defines what counts as environmentally sustainable and requires alignment disclosures for in-scope companies. | Procurement contracts should set expectations for Taxonomy-aligned practices and measurable KPIs. |

| CBAM | Importers must now report embedded emissions for covered goods (e.g. steel, cement). Authorisations due by 31 Mar 2026. | Supply contracts require emissions documentation and verification for imports. |

| EUDR | From 30 Dec 2026, medium and large operators must perform deforestation due diligence with full supply-chain traceability. | Supplier contracts must cover traceability, geolocation data, and audit rights. |

With Scope 3 often making up 70–90% of total emissions, supplier ESG clauses become essential for compliance.

Benefits and risk management for ESG compliance

Aligning contracts with ESG reporting brings several operational benefits:

- Improved data accuracy: Shared responsibility and clear obligations reduce reporting gaps.

- Reduced risk: Proactive clauses help avoid penalties, interruptions, or failed public pledges.

- Strategic value: Contract data supports investor demands and future ESG planning.

Of course, challenges remain. For example, clauses need to be clear, measurable, and kept up to date with changing ESG regulations. Standardization and automation through templates and playbooks help companies scale these practices across many suppliers.

Read next: 10 Best Contract Management Software in 2026

🔑 Key takeaways

- Contracts are the mechanism for collecting, validating, and enforcing ESG data, especially for supply chain Scope 3 emissions.

- 2026 milestones (CBAM full rollout, EUDR start, CSRD Wave 1) make contractual ESG clauses a must, not a nice-to-have, to meet compliance and avoid penalties.

- Effective ESG clauses drive better data, ongoing monitoring, and remediation across global procurement networks.

- CLM tools and templates enable consistent, scalable, and auditable ESG reporting company-wide.

- Standardized, enforceable contracts underpin sustainable procurement and ethical sourcing expectations in highly regulated markets.

FAQs

Because most ESG data, especially Scope 3 emissions, comes from suppliers. Contracts create enforceable obligations to collect, verify, and audit that data, which EU regulations increasingly require.

Key frameworks include CSRD (including Omnibus updates), the EU Taxonomy, CBAM, and the EU Deforestation Regulation (EUDR). Each relies on supplier-provided data, making contractual ESG obligations essential for compliance.

Focus on clauses that produce measurable, auditable data: emissions reporting (Scope 1–3), audit and monitoring rights, environmental and social performance targets, and clear remediation or termination rights for non-compliance.

Contracts push reporting and verification requirements down the value chain. Without supplier clauses, companies have limited control over the data needed for Scope 3 disclosures.

CLM tools standardize ESG clauses, automate tracking and reminders, centralize supplier data, and create an audit trail, which helps ESG reporting to be more consistent, scalable, and defensible.

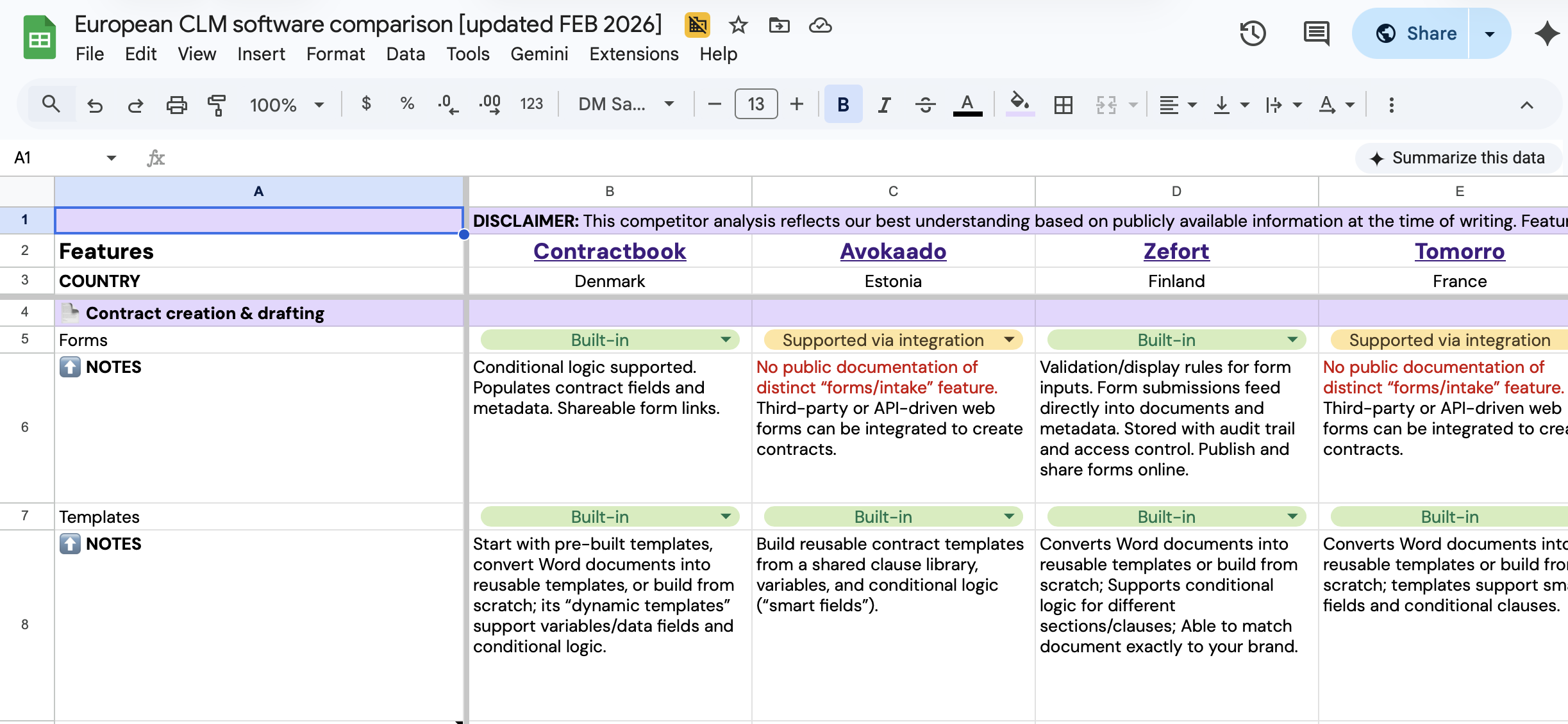

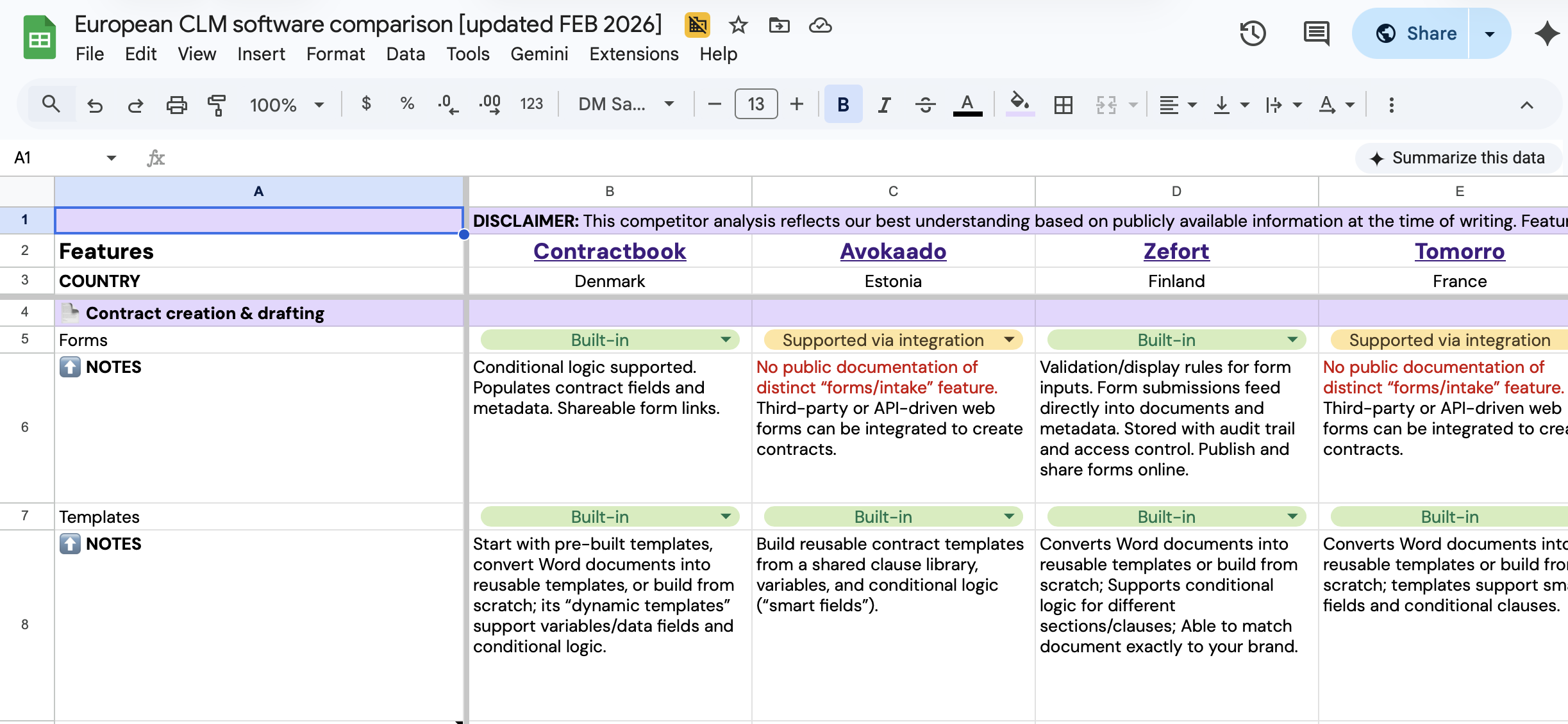

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.