From onboarding to oversight: preserving AML and KYC compliance throughout the contract lifecycle

Preserving anti money laundering (AML) and know your customer (KYC) compliance throughout the contract lifecycle takes more than a one-time check. Financial institutions, fintech players, and highly regulated businesses must keep compliance standards active from onboarding to offboarding. Lapses in compliance can carry costly consequences, including hefty fines, damage to credibility, and slowed growth. This article breaks down how to align AML and KYC measures with each contract phase, using Contract Lifecycle Management (CLM) systems to manage risk, updates, and regulatory readiness.

Key topics in this article:

- How AML/KYC requirements fit into every contract/client lifecycle phase

- Practical strategies for document traceability and audit trail reliability

- The role of CLM and technology in sustainable compliance

- Best practices to avoid common compliance pitfalls

Why AML and KYC compliance spans the full contract lifecycle

AML/KYC compliance is not a box-ticking exercise. Regulators require ongoing vigilance. Every contract or client relationship advances through phases: onboarding, active management, servicing, and closure. Each phase demands specific Customer Due Diligence (CDD) actions, with contractual clauses enforcing verification, review, and reporting duties.

Embedding these compliance steps in contract language helps clarify responsibilities. It also supports defensible audit trails for regulatory showings and internal review.

Key phases in contract/client lifecycle and compliance measures

Each stage of the contract lifecycle brings specific AML/KYC responsibilities. Businesses must tailor verification and reporting actions to match each phase.

| Phase | Description | AML/KYC Compliance Measures |

|---|---|---|

| Onboarding | Initial client identification and vetting before official engagement. | Run a strong Customer Identification Program (CIP). Perform standard or enhanced CDD, especially for high-risk clients. Ensure thorough ID, risk, and source of funds checks. CLM portals help clients submit and validate documents securely. |

| Ongoing monitoring & management | Active relationship management with real-time reviews and behavioral checks. | Conduct real-time screening for sanctions, expired documents, or unusual activity. Trigger AI alerts for suspicious events, use dynamic risk scoring, and document everything for full traceability. |

| Servicing & risk management | Account service, support, and periodical compliance reviews. | Use aggregated data views to spot risk trends. Refresh KYC periodically. Assign roles in contracts, making obligations visible to prevent lapses. |

| Offboarding/close-out | Closure of accounts or contracts, whether planned or risk-driven. | Complete final CDD to update records. Capture all closure steps in compliance documentation, storing copies for future audit needs. |

How CLM and technology enable continuous, audit-proof AML/KYC compliance

CLM platforms centralize compliance tasks along the customer journey. They minimize manual errors, enforce consistent CDD, and support stronger governance and oversight cross-functionally. The centralized system can help ensure every contract includes the right language, and every event, e.g. review, renewal, or breach, is logged for full document traceability.

- AI enhancements scan contracts for missing KYC clauses, monitor for upcoming renewals, and flag suspicious or non-compliant language. Still, human oversight remains key.

- Third-party integrations extend beyond direct clients to suppliers and partners. Automated KYC refreshes help spot red flags and keep compliance current even at the edges of your business ecosystem.

- Industry growth and adoption. Strong investor confidence, including recent funding rounds of up to €25 million and $50 million, underscores the accelerating demand for AI-powered CLM platforms.

Key Benefits include:

- Faster, compliant onboarding by completing all required regulatory KYC steps with automation and checks built into workflows.

- Lower operational and compliance costs through minimized manual work and error-prone tasks.

- Audit-ready documentation and traceability that strengthens regulatory readiness and risk posture.

- Strategic advantage in high-volume, regulated sectors such as asset management, payments, and financial services by turning compliance into a competitive differentiator.

With AML/KYC expectations and criminal tactics continually evolving, CLM softwares and supporting technologies not only safeguard compliance but can also enhance operational resilience, accelerate growth, and help organizations maintain regulatory readiness at every phase of the contract lifecycle.

Challenges and best practices for regulatory alignment

Relying on manual workflows risks errors, delays, or missed reminders, especially given strict directives like DORA or NIS2. Leading institutions rely on configurable CLM workflows, automatic alerts for expiring KYC documents, and regular updates as part of a “compliance by design” approach.

Best practices include:

- Start compliance checks at lead generation, not post-contract

- Script responsibilities and KYC review frequency into contract clauses

- Maintain complete, timestamped audit trails for all document actions

- Balance AI and automation with final human review for security and regulatory integrity

- Review and adapt controls regularly to match regulatory changes, particularly in financial crime, data privacy, and anti money laundering

Read next: How to choose a European contract management software: 5 things that matter

🔑 Key takeaways

Continuous compliance across the contract lifecycle enhances efficiency, reduces regulatory risk, and builds trust. Organizations that combine technology with policy discipline can future-proof their AML/KYC strategies.

- Continuous AML and KYC compliance demands a lifecycle approach, not one-off checks.

- Document traceability and audit trails protect against regulatory risk and provide defensible records.

- Advanced CLM systems automate recurring tasks, streamline onboarding, and support consistent governance and oversight.

- Combining AI and human review keeps compliance reliable and audit-ready for frameworks such as DORA or NIS2.

- Embedding compliance in every contract phase, from onboarding to offboarding, avoids regulatory gaps and builds long-term trust.

FAQs

AML and KYC compliance must be upheld at every stage, from onboarding to offboarding, because financial regulations require ongoing vigilance. Each phase brings specific due diligence and monitoring steps, ensuring risk remains managed, regulatory obligations are fulfilled, and audit trails are complete

Maintaining complete and timestamped audit trails for every action, from document submission to closure, ensures that compliance records are robust and defensible. This is essential for responding to audits and demonstrating regulatory adherence at any point in the contract lifecycle.

CLM systems centralize compliance tasks, automate customer due diligence checks, and document every change or review. They support consistent application of contract clauses, reduce manual errors, maintain audit trails, and enable faster responses to regulatory demands or risk events.

Effective practices include beginning checks early, scripting responsibilities in contracts, maintaining complete audit trails, balancing automation with human review, and regularly updating controls to reflect changing regulations in areas like financial crime and data privacy.

Configurable CLM workflows and regular reviews allow rapid adaptation to new regulations such as DORA or NIS2. Institutions should frequently update risk controls, contract language, and monitoring procedures to align with the latest compliance directives.

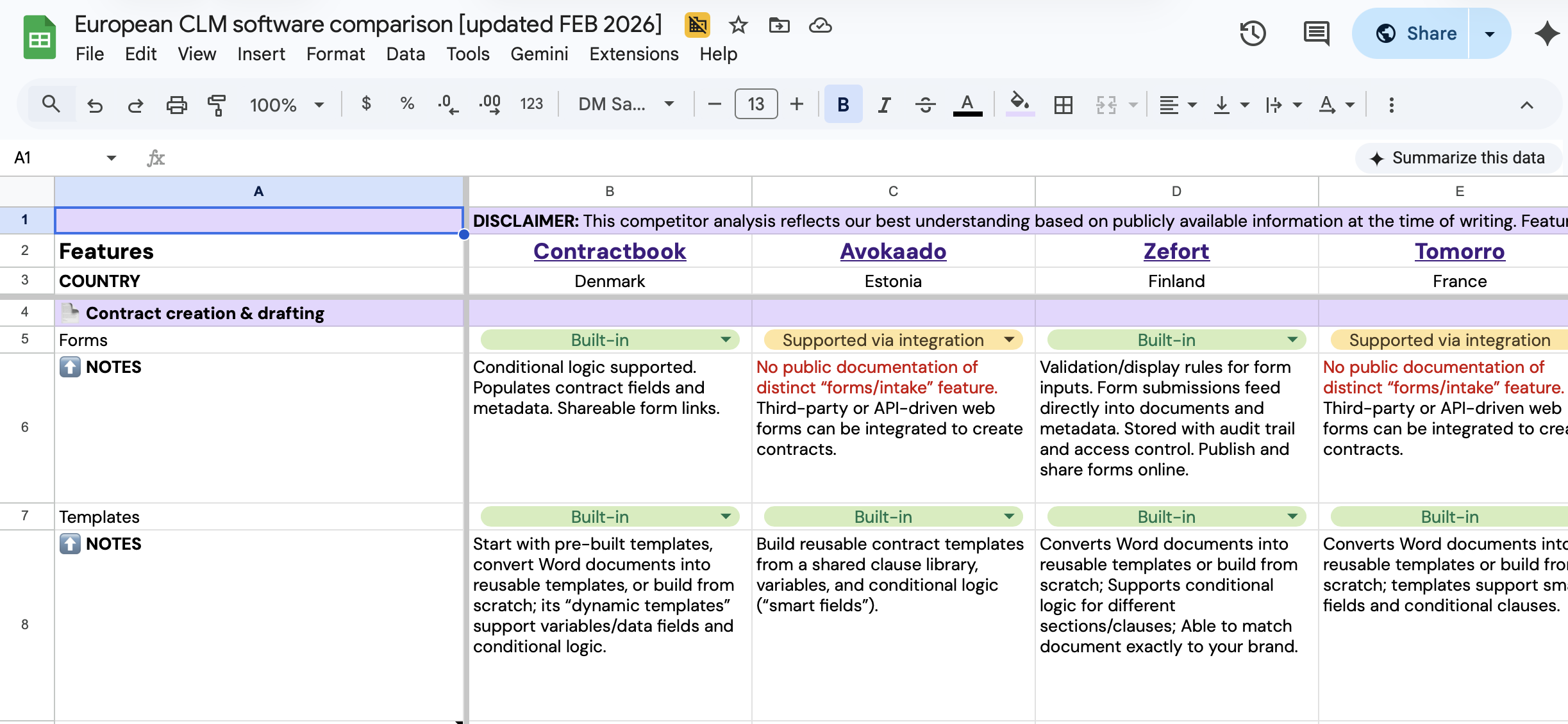

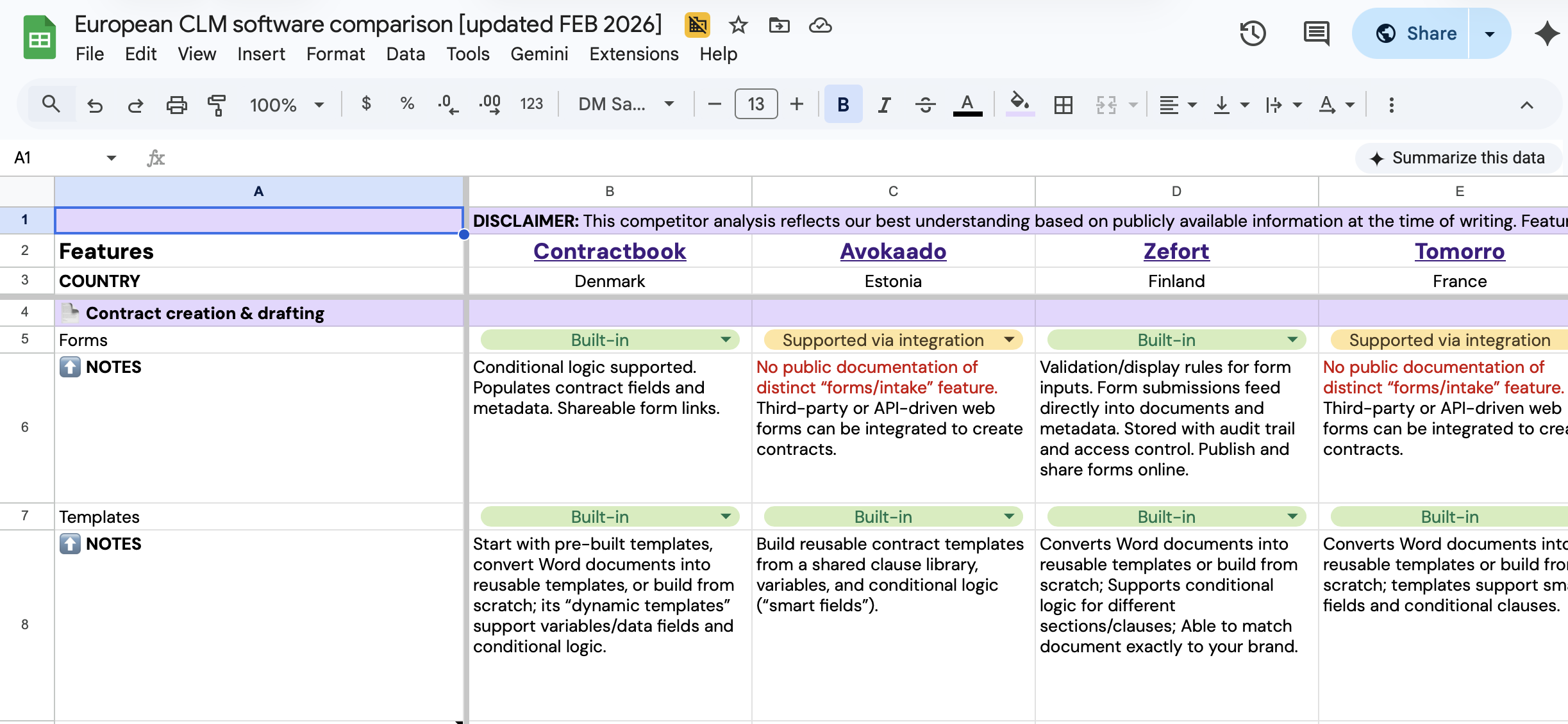

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.