Why contract visibility equals risk reduction

Contract visibility goes beyond storing contracts by providing organizations with real-time access, powerful search, and the ability to monitor every obligation, deadline, and status in one place. In regulated sectors such as banking, insurance, life sciences, healthcare, and manufacturing, agreement visibility is the difference between controlled risk and costly surprises.

This article explains how centralized contract governance reduces regulatory risk, prevents value leakage, and enables teams to act before issues escalate. It highlights how leading organizations use audits, automation, and structured oversight to avoid missed obligations and unnecessary renewals, and why full contract control is essential in regulated industries.

Understanding contract visibility and its compliance impact

What is contract visibility? In practice, it means instant retrieval of contract details, ongoing monitoring of terms, and timely alerts about obligations. According to recent contract management research, 71% of companies can’t locate at least 10% of their active contracts, which contributes to hidden costs, compliance risks, and missed obligations that undermine risk management and business value.

Centralized contract visibility turns each contract into an active risk management tool. For regulated European organizations, this directly supports compliance with frameworks like DORA and NIS2. Real-time searching and filtering make it possible to spot gaps, respond to audits, and benchmark terms at scale.

How visibility prevents common contract risks

Several risk drivers can be minimized or eliminated with purpose-built contract visibility:

- Proactive compliance monitoring: Audit terms against regulations or SLAs instantly. This flags deviations before they lead to fines during regulatory checks. In EU financial services, for example, centralized tracking makes DORA compliance more manageable and protects against multi-million-euro fines.

- Obligation and renewal tracking: Automated alerts for renewals, auto-renewal contract clauses, and discount periods prevent value leakage. Obligation and renewal tracking helps prevent value leakage during contract execution. WorldCC research shows that poor contract management practices can erode an average of roughly 8.6% of contract value through missed obligations, inefficiencies, and unmanaged performance. Automated tracking and SLA monitoring are key mechanisms that help organizations recover this lost value and avoid hidden costs from unfulfilled terms.

- Risk identification in high-impact contracts: Visibility into master service agreements, vendor terms, and data processing agreements helps teams spot hidden triggers such as change-of-control fees or evergreen clauses early.

Contract audits become less reactive. Automated monitoring and workflow tracking reduce legal and procurement workloads, allowing specialists to focus on high-value analysis instead of chasing signatures or tracking spreadsheets.

Industry impacts with real-world examples

Visibility into contractual data supports risk mitigation across diverse industries:

| Risk area | Visibility benefit | Industry impact example |

|---|---|---|

| Financial leakage | Tracks payments, discounts, and redundancies | Prevents 9% (€8.3 billion annually) revenue loss in procurement-heavy manufacturing |

| Regulatory non-compliance | Audits terms vs. laws and SLAs | Shields banking and insurance from penalties with centralized access |

| Litigation and disputes | Quick precedent search and amendment history | Accelerates resolution in life sciences vendor disputes |

| Operational disruptions | Real-time status and workflow tracking | Ensures healthcare SLA adherence to prevent supply chain failures |

Quantifying the business value of contract visibility

Contract lifecycle management platforms equipped with AI, contract playbooks, and integrations deliver measurable improvements:

- Much faster contract review and approval times, cutting administrative workload and the risk of outdated or unsigned agreements

- Reduction in maverick spend and untracked commitments as a direct outcome of centralized, searchable repositories

- Fewer missed renewals or auto-renewal penalties, leading to real financial savings

Organizations adopting CLM platforms register tangible ROI from decreased manual errors and better value capture. Auditability supports continuous contract compliance audits and enables legal, procurement, and business teams to focus on strategy over manual chasing.

Read next: Mastering digital contract management: A comprehensive guide

Why regulated industries cannot ignore contract visibility

In the EU, regulations continue to heighten scrutiny on data, operations, and supply chain contracts. General counsels in sectors like finance, healthcare, and manufacturing need contract visibility as an operational and strategic safeguard. Fines, value leakage, or supply interruptions can easily exceed the cost of advanced CLM platform benefits for compliance, auditability, and contract obligation management.

Industry experts emphasize that missed obligations and SLAs are more likely when organizations lack unified contract visibility, leading to unplanned operational friction. Turning contracts from static files into structured, data-driven assets is a baseline expectation.

🔑 Key takeaways

- Contract visibility turns documents into risk management tools, supporting compliance, audits, and proactive monitoring.

- Regulated industries see tangible ROI through reduced value leakage and fewer compliance incidents.

- Automation, centralized search, and alerts prevent missed renewals and obligations, and reduce contract audit risk.

- Auditability and access give legal and procurement teams stronger control, speeding up audits and negotiations.

- Contract visibility is a strategic requirement, not a luxury, especially where fines, litigation, or operational failures threaten revenue and reputation.

FAQs

Contract visibility gives organizations real-time access to contract details, enabling continuous monitoring of terms and obligations. This centralized oversight helps identify regulatory deviations early, reduces the risk of non-compliance fines, and streamlines audit responses, which is especially crucial in regulated sectors like finance, healthcare, and manufacturing.

Improved contract visibility helps manage several risks, including compliance breaches, financial leakage from missed obligations or discounts, litigation due to unclear terms, and operational disruptions from untracked renewals or service levels. Real-time monitoring and alerts support proactive risk mitigation for organizations across multiple industries.

Automated alerts monitor key dates such as renewals or deadlines, notifying teams before obligations are overlooked. This reduces the chance of incurring penalties, missing discounts, or automatically renewing unfavorable contracts. Such mechanisms help prevent value loss and support ongoing compliance efforts.

Organizations with centralized contract management often see faster contract processing with quicker reviews and approvals. There are also fewer missed renewals and penalties, reduced manual errors, and significant decreases in untracked or maverick spending, directly protecting revenue and improving audit readiness.

Regulated sectors like banking, insurance, life sciences, and healthcare face strict compliance requirements and potential fines for violations. Contract visibility ensures all obligations, terms, and SLAs are monitored and accessible, minimizing the risk of costly errors and enabling timely, informed responses to audits.

By making contract terms and obligations easily searchable and trackable, organizations can avoid missed discounts, payment errors, or renewal penalties. In sectors such as manufacturing, improved visibility has been linked to preventing up to 9% of annual revenue loss associated with procurement inefficiencies.

Centralized and searchable contract data reduces administrative workloads and manual tracking. Teams can resolve disputes faster, ensure service levels are met, and shift focus to high-value analysis instead of routine contract monitoring. This leads to smoother operations and less disruption across departments.

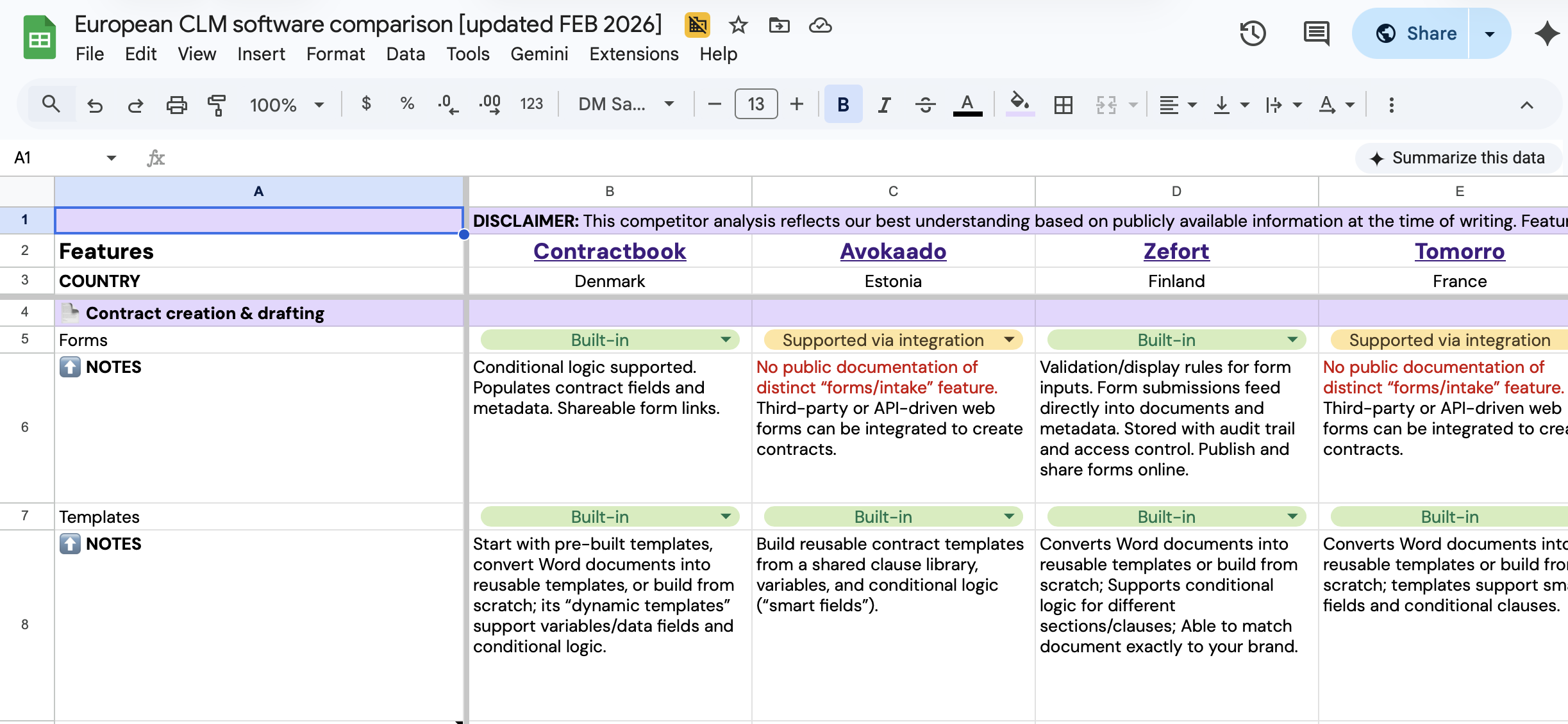

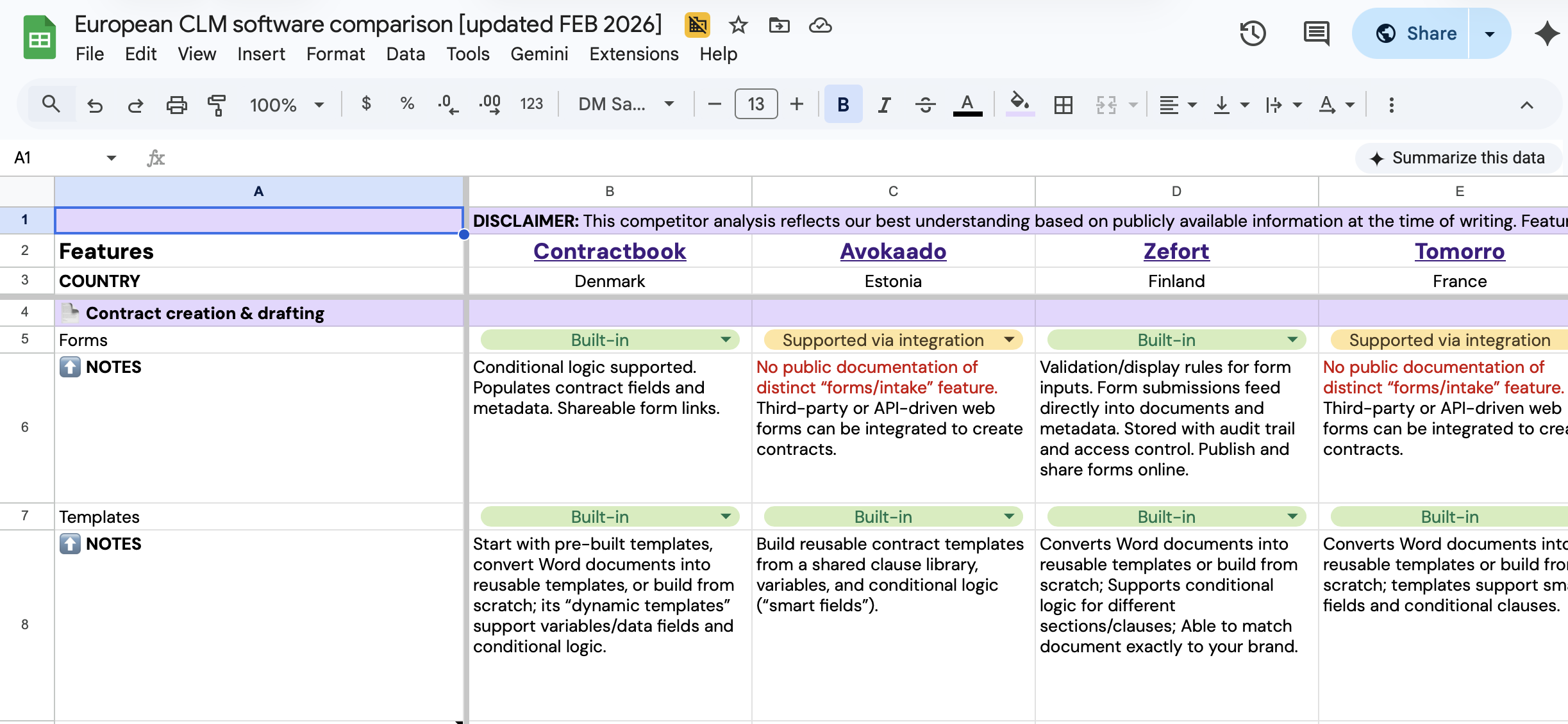

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.