How financial institutions use CLM to meet compliance demands

Financial institutions face constant regulatory change, complex counterparties, and intense scrutiny. Contract Lifecycle Management (CLM) helps legal, procurement, and compliance teams stay in control by turning contracts into structured, searchable, and auditable data, not scattered PDFs.

What we’ll cover:

- How CLM supports regulatory compliance for financial institutions

- Ways CLM reduces operational, legal, and third-party risk

- How to align CLM with DORA, NIS2, GDPR, and AML/KYC rules

- Practical steps to embed compliance into daily contract work

Why compliance pressures push financial institutions toward CLM

Regulators expect financial firms to know exactly who they contract with, on what terms, and with what risks. That is hard to do with shared drives, email attachments, and manual spreadsheets.

CLM does not replace compliance programs, but it gives them structure. It centralizes contracts, standardizes clauses, and provides a clear audit trail. Industry-focused guides and frameworks help translate regulatory text into concrete contract obligations you can manage with CLM.

How CLM supports key regulatory frameworks

The Digital Operational Resilience Act (DORA) and NIS2 raise the bar for how financial institutions manage ICT and critical suppliers. Contracts play a central role in proving that you control third-party risk.

With CLM, you can:

- Tag and track critical ICT contracts across cloud, data, and infrastructure providers.

- Standardize clauses on incident reporting, resilience, data location, and subcontractors.

- Search and report which contracts contain DORA- or NIS2-aligned terms, and which need remediation.

Regulators expect you to show how you govern third-party risk at scale. CLM helps you prove that you have identified critical suppliers, enforced required clauses, and documented approval flows.

Anti-Money Laundering (AML), Know Your Customer (KYC), and sanctions rules impact how you onboard clients, distributors, and intermediaries. Contract terms need to reflect your risk appetite and legal obligations.

CLM supports this by enabling you to:

- Embed standard AML/KYC language in templates for distributors, agents, and partners.

- Connect counterparties to their KYC status and documentation references.

- Set alerts for contract renewals when a new KYC review is required.

This keeps legal, procurement, and compliance teams aligned. Contract data becomes a reliable input for your broader AML and sanctions control framework, not a blind spot. GDPR and similar regulations require clear accountability for personal data between controllers and processors. Contractual arrangements are a core part of compliance.

Using CLM, financial institutions can:

- Maintain a library of approved data processing clauses and Data Processing Agreements (DPAs).

- Classify contracts that involve personal data, sensitive data, or cross-border transfers.

- Track key obligations like breach notification times, audit rights, and deletion requirements.

When a breach occurs or a Data Protection Authority requests information, teams can quickly identify which contracts are involved, rather than searching through scattered folders and emails.

Reducing risk through contract standardization and visibility

Regulated institutions depend on consistent contract language. Variations increase legal risk and make monitoring difficult.

CLM supports standardization by letting you:

- Use approved templates for common contract types, aligned with your legal and compliance policy.

- Apply clause libraries and playbooks so negotiators stay within policy and know which fallbacks are acceptable.

- Control deviations by routing non-standard terms to the right reviewers.

This keeps contracts closer to policy and reduces time spent fixing issues later during audits or remediation projects.

Auditors, both internal and external, expect fast, accurate data about contract obligations, rights, and counterparties. Manual collection slows down audits and increases cost.

With CLM, you can:

- Filter contracts by jurisdiction, product, business unit, or risk profile.

- Export contract metadata and key terms into reports in minutes.

- Show approval history, including who approved what and when.

This shortens audit timelines and reduces the burden on legal and compliance teams. Contracts become searchable records, not one-off firefighting exercises.

Embedding compliance into day-to-day contract work

Compliance fails most often at the handover points: between sales and legal, or between procurement and vendor management. CLM creates one shared view of the contract process.

Financial institutions use CLM to:

- Define clear workflows for drafting, review, approval and post-signature management, based on contract type and risk.

- Document decisions and risk acceptances in the contract record.

- Train teams with industry-focused guides and playbooks embedded in templates.

This reduces the number of “shadow contracts” that bypass review and keeps compliance expectations visible for everyone involved.

Contract data feeds into many regulatory reports: outsourcing registers, operational risk assessments, and concentration risk reviews. CLM turns contract metadata into usable information.

Typical use cases include:

- Maintaining an outsourcing register with current contract status, renewal dates, and criticality.

- Mapping concentration risk across key suppliers and counterparties.

- Supporting scenario and stress testing by showing where key dependencies sit in your contracts.

See also: How to choose the right CLM software for your organization?

🔑 Key takeaways

- CLM helps financial institutions meet compliance demands by centralizing contracts and turning them into structured, searchable data.

- Regulatory frameworks like DORA, NIS2, GDPR, and AML/KYC rely on strong contractual controls, which CLM supports through standard clauses and clear workflows.

- Standardization and visibility reduce legal, operational, and third-party risk, and make audits faster and more reliable.

- Embedding compliance into contract workflows keeps legal, procurement, and business teams aligned and reduces “shadow contracting.”

- Using CLM data for risk and regulatory reporting turns contracts into an active part of your governance and resilience strategy, not a static archive.

FAQs

Choosing the right Contract Lifecycle Management (CLM) software involves understanding your internal needs, evaluating usability, integration readiness, automation capabilities, reporting features, scalability, and vendor support. Effective CLM should simplify workflows, reduce manual work, improve compliance, and offer visibility into obligations and deadlines.

Focus on usability, integration with existing tools, automation and workflow capabilities, search and reporting functions, scalability to handle growing contract volumes, and vendor support for onboarding and ongoing development.

Zefort simplifies contract management with a searchable archive, flexible automations to handle repetitive tasks, easy integrations with CRMs and e-signing tools, automated reminders for deadlines and renewals, and a clean interface that encourages adoption across teams. It scales with your organization’s needs.

Smart contracts are code-based digital agreements that automatically execute when predefined conditions are met, ideal for rule-based or recurring contracts. Contract intelligence uses AI to analyze contract text, identifying obligations, risks, and unusual clauses. Together, they improve efficiency and reduce errors in contract management.

AI supports contract risk management by quickly reviewing contracts, detecting unclear terms, missing obligations, unusual clauses, and compliance gaps. Contract analytics tools learn from past contracts to highlight risks and provide actionable insights, helping teams take proactive measures before issues arise.

CLM helps financial institutions centralize contracts, apply standard clauses, and maintain a structured, searchable record of obligations and approvals. This supports compliance with regulations like DORA, NIS2, GDPR, and AML/KYC, reduces operational and legal risk, and makes audits faster and more reliable.

Financial institutions can define clear workflows for drafting, review, and approval, document decisions and risk acceptances in the CLM, embed industry-focused guides in templates, track critical suppliers and obligations, and convert contract metadata into actionable insights for regulatory reporting.

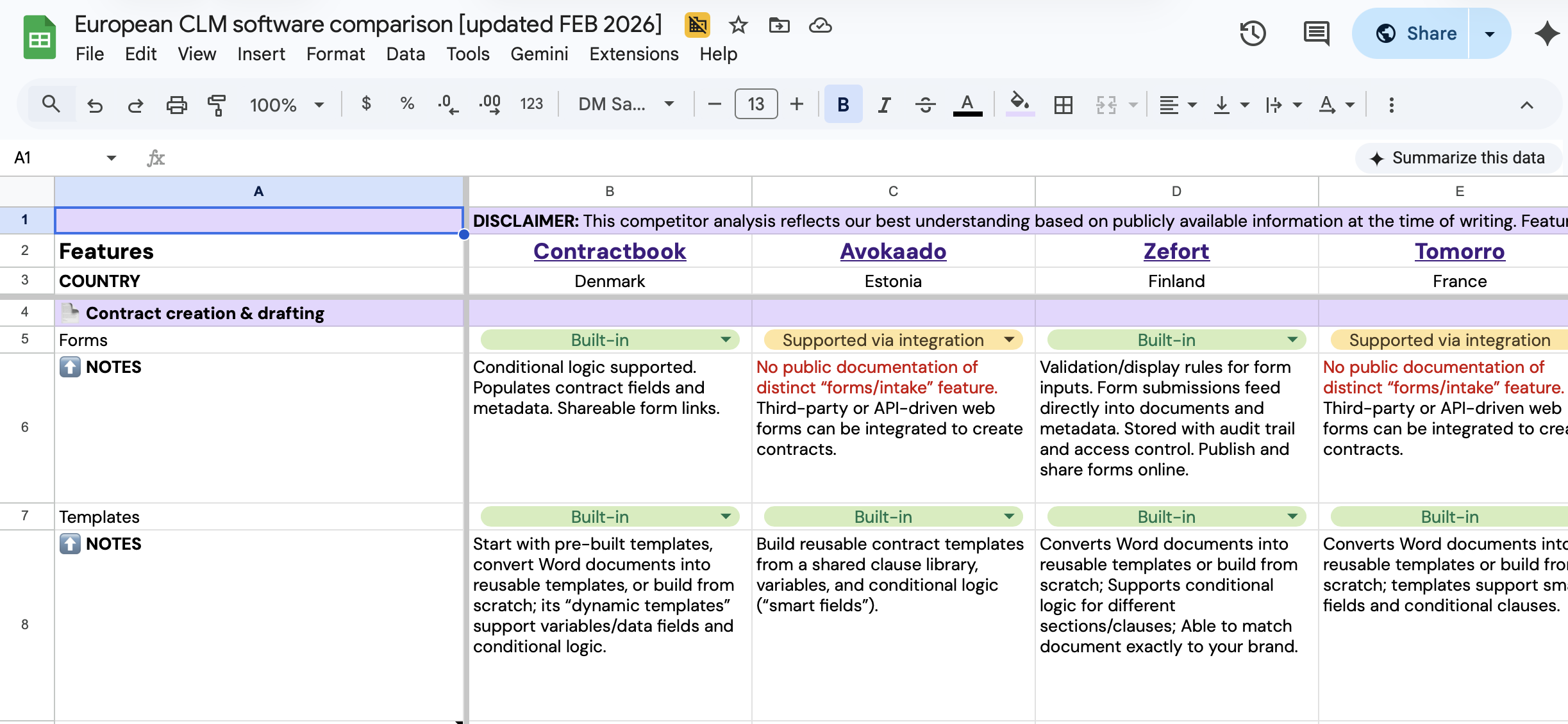

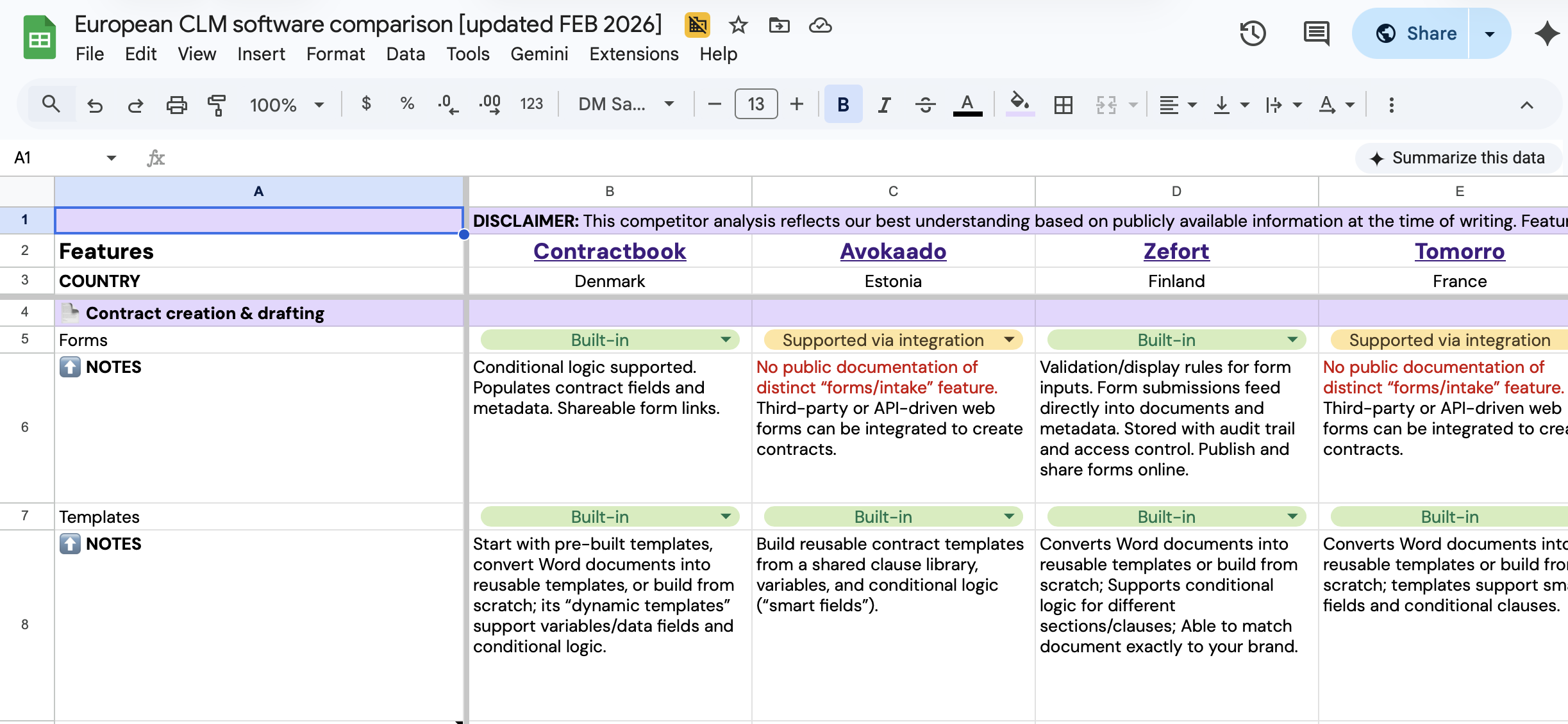

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.

Compare European CLM leaders

Get a comprehensive breakdown of the top CLM solutions in one spreadsheet.